How To Trade Overbought And Oversold Forex Markets. It might take a bit of investigation but this knowledge allows us to better understand if the new level is warranted and anticipate what may happen next. A lot of new Forex traders think that all they have to do in Forex trading is to Buy in an Uptrend and Sell in a Downtrend.

A lot of new Forex traders think that all they have to do in Forex trading is to Buy in an Uptrend and Sell in a Downtrend.

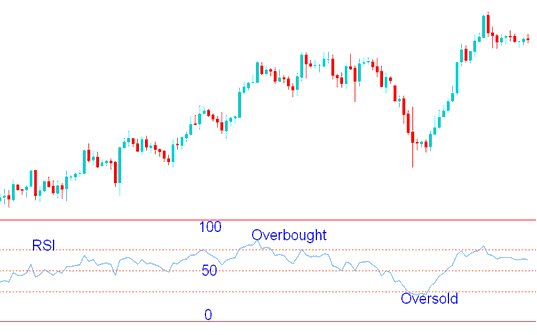

Swing Trading with Overbought and Oversold Areas.

Furthermore, it defines the overbought and oversold conditions of the market. The following are three ways the stochastic indicator can be effectively used in your trading. While this is a general truth, there are a lot of other factors like the overbought and oversold conditions which determine whether a trade is going to end in profit or not.